In today’s fast pace world we all wants to retire early with a hefty amount of money so that we can life our rest of our life in peace. So what’s the actual formula to do that ? Well, there are some parameters from which you can actually make that possible.

What are the key factors of a multibagger ?

1. Fundamentals

Yes, you have to watch out for fundamentals because this is the most basic thing to look out as it reduces the future default of the stock.

Now if we talk about the factors which affects the fundamentals of a company so those are :

Firstly balance sheet, yes you have to see for the assets and liabilities, secondly cash flow of the company and lastly income the most vital because if it is not profitable how we can invest in .

Secondly cash flow, well it make stock less defaulting because if a company has free cash flow or a reserve then it will always be eligible for paying off the uncertainties, now whether it has came through debt or any bad situation

Laslty see the income and revenue statement, well I have kept it at last because if a company doesn’t making any such income on which a lot of things depends, then how could someone invest in such kind of companies.

2. Return on equity

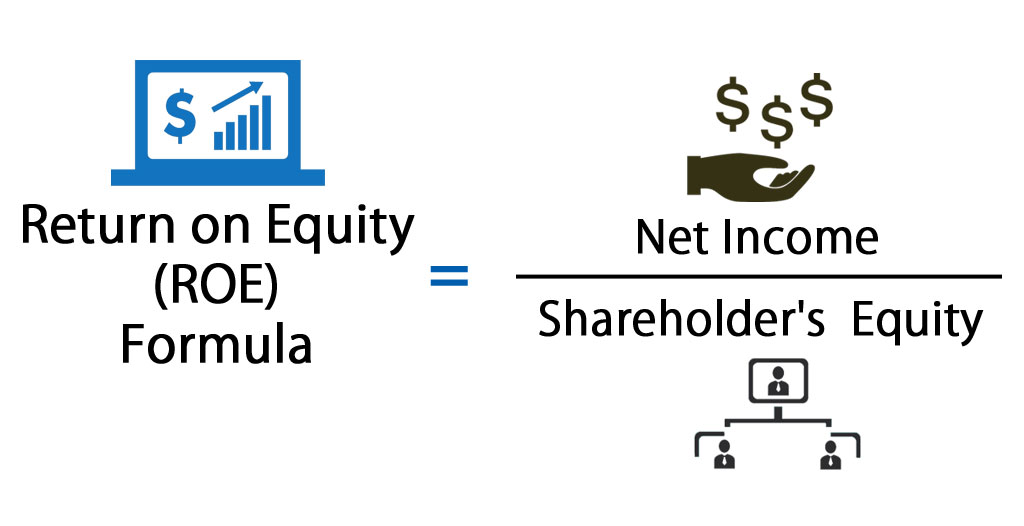

Return on equity is the advantage which you will get on capital employed. Your money should increase that is why it is crucial to think about the return your money will generate.

Formula for return on equity :

It should be greater than 20% because it will be only be going to make that stock a multibagger.

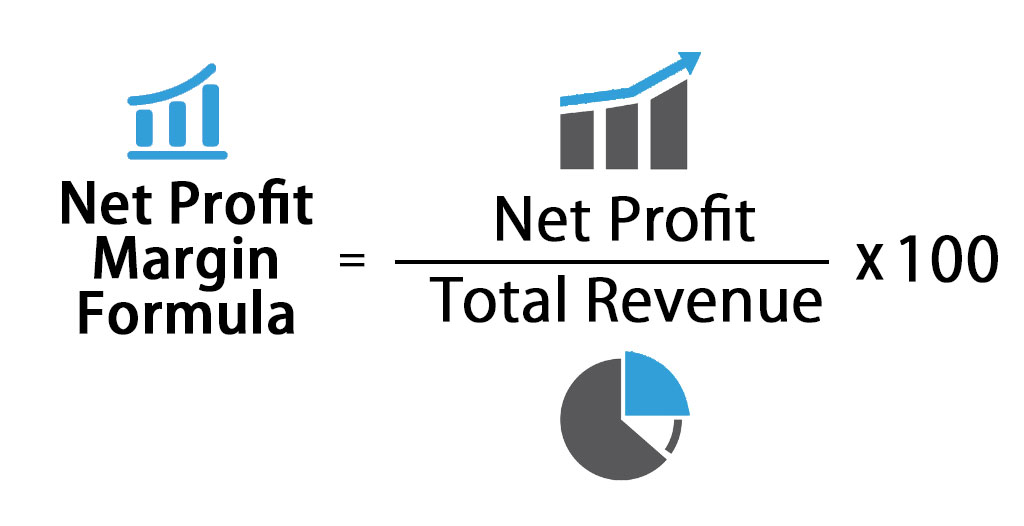

3. Net profit margin

The net profit margin, or simply net margin, measures how much net income or profit is generated as a percentage of revenue. It is the ratio of net profits to revenues for a company or business segment.

4. PE ratio

PE ratio is simply a calculation of how many years it will going to take for earning 1$ on your part of money.

A higher PE means company is overvalued and a lower PE means company is Undervalued, now PE should less than 20 than it will be good. But also the PE ratio your chosen stock should be less than the industry PE because it should be compatible with other peers of its industry also.

5. Sales and profit growth

The sales growth rate measures the rate at which a business is able to increase revenue from sales during a fixed period of time. It should be minimum 15%

At the end I would say you should also take a look on to the company’s uniqueness in the segment, what actually it is doing different from its peers.