It’s a ratio which is use to define price action or patterns and breakout. It is actually used by the intraday traders who predict the price action of a stock on the basis of Volatility, but if you are a long term investor who doesn’t care about one particular day price then you should not care about it because you are trusting the fundamentals and potential growth of the company.

Volatility Ratio Formula

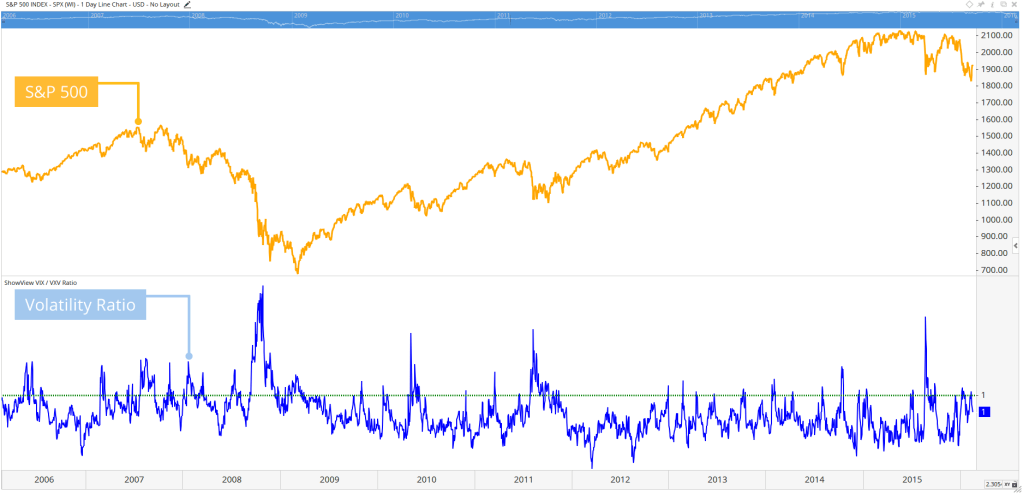

It is calculated by dividing the implied volatility of an stock by the historical volatility of that stock. A ratio of 1.0 means that the price is fair. A ratio of 1.3 implies that the option is most likely overpriced, and is selling at a price that is 30% higher than its real value.

HOW IT WORKS ?

It came to work when you are purchasing a high volume stock because there will more volatility. As you will see a lots of ups and downs.

Like you can see in the above stock it is volatile wholly. These stocks are being speculated by a lots of insiders. As they all basically use pump and dump stratergy to manipulate stocks, so that they can earn some amount of profit on a daily basis. It could happen only with high risky companies which have lost market share or one which is overhyped or overvalued. They are like cryptos only as it also fluctuates a lot in a day.

NOW WHAT TO DO WITH THESE KIND OF STOCKS ?

Well, this question is obvious because everyone wants to make profit out of everything wether it is risky or not, avoid taking entry into these kind of stocks until and unless you know the business or you see some potential in that stock for future because that will be going to be a complete different thing.