If you are young and in your twenties so this is a good time to take risk and make mistakes as in this phase you people don’t have enough responsibilities as it will be in future .

▁Investment is basically a process of creating wealth for future and also you could create money in short term, it depends on the purpose of investing because this world is so vast.

How it actually works

Investing your hard-earned money in assets, which can generate enough returns to sustain through your retired life is very important. Investing is a life long affair and one has to devise an efficient plan to save and invest throughout the working years.

Before we understand why one should invest, let us figure out what happens if we choose not to invest.

Assume you earn 50K per month, of which, you spend 30K towards the cost of living, and therefore left with 20K in surplus every month. You choose not to invest this monthly surplus and leave that cash as-is. Now, the question is, at this rate, how much money will you have by the time you retire? For the sake of simplicity, let us ignore the effect of tax and make a few simple assumptions .

• Your employer is kind enough to give you a 10% salary hike every year

• The cost of living increases by 8% year on year

• You are 30 years old (now) and plan to retire at the age of 50, this implies you have 20 working years left

• You don’t intend to work

• Your expenses are fixed and don’t foresee any other expense

• The balance cash of 20K per month is retained in the form of cash, probably in your bank’s savings account

Take some time, maybe get a pen and paper and do the math. At this rate, can you work out the amount of money you would be left with by the time you retire?

Okay let me show you some simple maths

Calculations

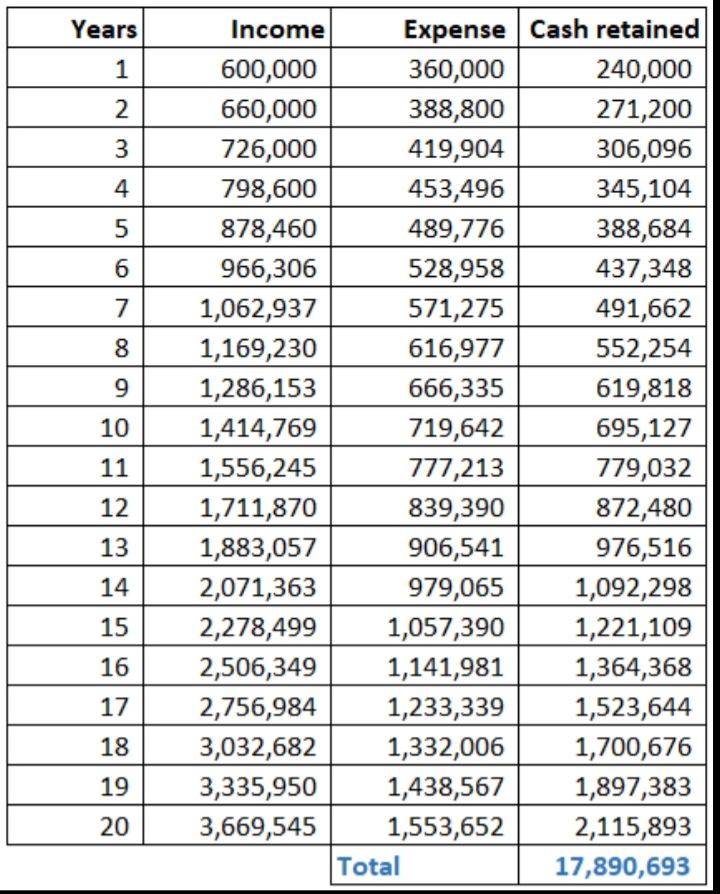

Here is the math –

• 1st year you earn Rs.600,000/- i.e Rs.50,000 per month 12 months

• Your yearly expenses are Rs.360,000/ i.e Rs.30,000 per month 12 months

• Your yearly savings is Rs.240,000/- i.e Rs.20,000 per month 12 months *

• The 2nd year, you get a hike of 10%, so you earn Rs.660,000.

• The expenses increases by 8%, so do the retained cash.

• So on and so forth

• After 20 years of hard work you accumulate 1.7 Crore

• Expenses are fixed, your lifestyle has not changed over the years, you probably even suppressed your lifelong aspirations – better home, a better car, international vacations etc

• Post-retirement, assuming the expenses will continue to grow at 8%, 1.7Crs is good enough to sail you through roughly 8 years of post-retirement life. 8th year onwards you are likely in a very tight spot with literally no savings left to back you up.

What would you do after you run out of all the money in 8 years’ time? How do you fund your life? Is there a way to ensure that you collect a larger sum at the end of 20 years?

Higher the risk is ,the higher the returns will be .